Jack and Sally are neighbors. Jack rents his house from a landlord, while Sally owns her home. They both pay similar housing costs each month to enjoy the neighborhood in which they live. What’s the big difference between the two? Equity. Sally’s monthly payments are working for her, helping her to gain financial stability. Jack’s, on the other hand, are going straight into his landlord’s pockets.

When you own your home, it’s more than just a place to live; it’s also a financial asset. As you pay your mortgage each month, the money you put toward principal acts as a kind of forced savings. In other words, your money is never really “going down the drain,” so to speak. That’s because, as you pay down principal, your equity (the amount of your home you actually own) grows. This equity can eventually become liquid cash that you can access, either by selling your home or borrowing against it.

When you own your home, it’s more than just a place to live; it’s also a financial asset. As you pay your mortgage each month, the money you put toward principal acts as a kind of forced savings. In other words, your money is never really “going down the drain,” so to speak. That’s because, as you pay down principal, your equity (the amount of your home you actually own) grows. This equity can eventually become liquid cash that you can access, either by selling your home or borrowing against it.

While there are undoubtedly other ways to grow your wealth, and you should explore all the possible avenues available to you*, the truth is this: We all need a place to live. If you’re going to pay housing costs each month, you might as well build equity while you’re at it.

While there are undoubtedly other ways to grow your wealth, and you should explore all the possible avenues available to you*, the truth is this: We all need a place to live. If you’re going to pay housing costs each month, you might as well build equity while you’re at it.

![]()

![]() Put more down when you buy.

Put more down when you buy.

If you’re not already a homeowner but are considering taking the plunge, the more you can put toward your down payment, the more equity you’ll have right off the bat.

![]() Pay your mortgage (and then some).

Pay your mortgage (and then some).

We’ve already established that paying your mortgage helps you to build equity, but if you can make extra payments, you’ll grow your equity even faster (and be able to pay off your loan sooner).

![]() Make improvements.

Make improvements.

Adding a little TLC to your home, like an updated kitchen or bath, can increase its value and boost your equity. Just be careful about which projects you choose. Even though your home’s value may increase, it doesn’t mean you’ll recoup all the money you put into it. Check out these home upgrades that provide the biggest payback.

![]() Add curb appeal.

Add curb appeal.

According to Consumer Reports, improving your home’s curb appeal can boost its value by about 3%-5%. And you don’t have to hire a landscape architect to realize a significant change. Simple things like trimming shrubs, planting flowers, painting your front door, and pressure washing the siding can make a big difference for just a few bucks.

![]() Shorten your loan term.

Shorten your loan term.

Choosing (or switching to) a 15-year loan can help you gain equity much faster than the more common 30-year mortgage. The tradeoff, however, means much higher monthly payments, which can make it harder to qualify for your loan. Talk to me about whether this would be a good option for you based on your current financial situation.

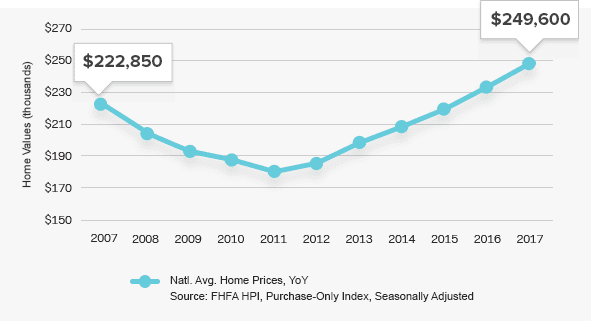

If you’re currently a homeowner, there’s a good chance you may already have equity available to you. According to CoreLogic, the average annual equity gain for homeowners in the third quarter of 2017 was $14,888. In addition, data from the Federal Reserve revealed that homeowner equity jumped 10.3% from Q1 2017 to Q1 2018 — with a 3.5% increase in the first quarter of 2018 alone. To top things off, home values have surpassed their pre-recession peaks by 16%, according to the Federal Housing Finance Agency.